Two

observations I have seen since I became a mortgage banker on October 1st

1991: 1) the most commonly asked

question in the mortgage business is, “What is your interest rate?” and 2) the

biggest change I have seen in the last twenty three years in the mortgage

business is rates move on emotion and speculation, before economic data is released and studied. How are these two observations linked

together?

Interest

rates have major impact on monthly payment.

Homeowners want to know what price range they should be shopping in and

what mortgage payment they can afford.

Rates dictate affordability in the buyer’s mind. Rates are constantly advertised and used as a

primary decision maker for purchasing or refinancing. Mortgage companies go to great lengths to

advertise interest rates. Governments

attempt to stimulate or slow the economy thru regulating rates. In short, the perception is interest rates

rule the psyche of the consumer.

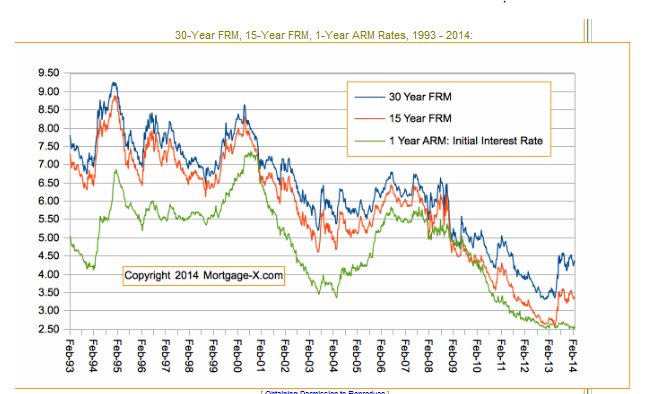

So it is no

surprise that mortgage bankers are asked to predict the future of rates every

time we answer the phone. Based on this historical chart it is easy to

predict rates will go up. The only

question is “when?” The answer is

simple. Rates will go up when

speculation and emotion drive them up.

When I entered the mortgage business economic data would come out first,

suggesting how strong the economy was (or was not) and rates would move

accordingly, providing a true reflection of the state of our economy. Today, perhaps much like the stock market, the

market prices interest rates in anticipation

of what economic data will be released and speculative

interpretation of how that signals the state of our economy.

A recent

move in interest rates serves as a great example of this observation. Fifty three weeks ago, interest rates for a

30 year fix were resting at close to a 42 year low. Then one Tuesday, the Federal Reserve hinted

that the Federal Government would begin tapering off on their monthly purchase

of Mortgage Backed Securities (MBS). In

the span of 4 hours, rates rocketed to .75% in rate, rates moved from 3.5%

range to 4.25% range on a 30 year fixed.

“When is turns, it burns” and ouch…that day left a scorching burn! Keep in mind the cause of this rocket- like

rise was a hint……a hint the government was tapering.

|

| Reprodeced with the permission of Mortgage-X.com |

None of us

need to be a recognized, published economist to understand rates are low,

really low and affordability is up. Historical data suggest we are near the

basement of the interest rate cycle.

Rates will go up. The question is

when will rates go up? Many “experts” believe

rates will stay low for a while. The

government has a huge debt service. Low

interest rates are in the government’s best interest. The economy is getting stronger. Jobs are coming back from overseas to

America. Some prognosticators believe

the DOW is going to 18,000 +. Today,

one year later, many experts see tapering as a positive sign the economy can

stand without the aid of the government.

What a difference a year makes!

Consumer confidence is going up and unemployment is going down. We are in an election year (just ask Eric

Cantor). All these factors suggest rates

should stay steady for a while. But as

Lee Corso says every Saturday on ESPN in the fall, “Not so fast my

friend!” Nothing, and I mean nothing

makes rates race up like inflationary fears. Beware that the speculation of inflation is

growing like a tidal wave at sea. Be

alert and listen for the anticipation of inflation. The government keeps a watchful eye on

inflation. Short of a national tragedy,

nothing will make for a dramatic increase in rates go up in a recovering

economy like inflationary fears.

So do not

fear “inflationary fears”. Anticipate

it. Lock in on rates at your first

opportunity. Do not find yourself in the

same shocking position as those 53 weeks ago who returned from lunch to learn

rates had jumped from 3.5% range to 4.25% range one afternoon in the

summer. There is no warning of rates

going up when speculation and emotion gain momentum…..especially when it

relates to inflation. Remember gasoline

prices going from $1.50 to $3.00/ gallon overnight? Bingo!