CoreLogic, a financial data firm, published its annual HPI Forecast that predicts monthly home price gains and annual pricing trends stated it is expected that home prices will rise from July 2014 to July 2015 by 5.7%. July is the time for families with school age children who make enrollment a priority when relocating. Following winter break is another time that home demands may be on the rise and may precipitate price gains.

Generally speaking the consensus is that residential property values will continue rising in 2015 but at a slower pace than what has been seen in the previous 12 months.

A map featured in this article indicates cities that may see a double-digit price gain include ten cities in California, Reno and Las Vegas, Nevada. Zillow uses their predictions based on their own pricing models, housing trends, sales prices, and other data.

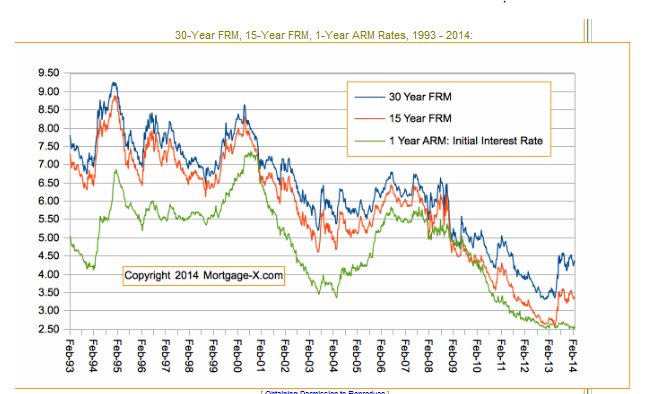

Prediction 3: Mortgage Rates should remain low through first half of 2015.

In the latest comments from the Federal Reserve earlier this month, the Fed indicated they plan on keeping rates relatively low for the first part of 2015. Rates today resemble the historic rates of Dec of 2007 for the 30 year conventional fixed rate. Unlike 2007 though, the Jumbo rates are much lower today than seven years ago. Additionally government rates are as low as I have seen them in my 23 year mortgage career. Do not rule out some rate volatility as both the stock market and bond market move now on predictions, speculation, and emotion as opposed to logic and data. But overall rates will assist in making home buying affordable in all price points. This is a nice Christmas present from the Fed as we begin 2015.

When the housing market crashed, activity of home foreclosures was on the rise and continued to remain so over the last few years. Soon foreclosures declined which brought back confidence to the real estate market, both to buyers and sellers. With competitive, low mortgage rates, buyers anticipated the joys of home ownership. Distressed properties were fewer and values of homes were appraised closer to their true value. This confidence was uplifting to the real estate market and mortgage lenders.

Prediction 5: Mortgages Will Be Easier to Obtain.

In July, the Federal Reserve released a report that stated mortgage lenders are “relaxing their standards” mostly in debt ratios and credit scores. Lenders are allowing for credit scores to be lower and debt ratios to be higher for borrowers. The reason for this “relaxation” is due to the reduction in loan applications. Lenders needed to increase the volume of borrowers, and found the best solution was to loosen their lending standards.

In Vegas, the house always wins eventually. In 2015, the Loan StarTeam sees homebuyers winning. There is a perfect formula in play here: reasonable and rational appreciation of homes, affordability with low rates merged with a renewed sense of consumer confidence, and lower unemployment numbers. 2015 could be the best time for buying and selling real estate in the last seven years. Here is to 2015, a year we all win in the housing market.