Sunday, February 8, 2015

Filing Homestead Exemption Is Near

The beginning of a new year reminds us that the tax season is soon approaching. As a first time homebuyer or if you recently purchased a new property, you have a tremendous tax advantage and may be eligible for what is known as Homestead Exemption. The term homestead exemption can refer to exemptions from property tax that homeowners can claim. It can also refer to homestead protection, which protects a person's primary residence in the case of financial hardship, such as the death of a spouse.

Homestead Exemption laws are not the same in all states. Some states provide automatic protection under the law, while other states require the filing of a claim for Homestead Exemption. In Georgia, it is required that you file a claim for Homestead Exemption. An important note is that your registration of all vehicles and filing of your Georgia and Federal State income taxes must reflect your primary residence address. A claim for Homestead Exemption may not be made on any rental or vacant property, or more than one property. Interestingly enough, as a homeowner, you may lose your right to Homestead Exemption if you abandon the property or if you should occupy a different primary residence than the one previously claimed.

If you have occupied your new residence on January 1st, you will need to file in person, online or by mail at the County Courthouse or Tax Commissioners Office. The amounts of exemption will vary for each county and filing procedures may be different. Typically, filing applications in Georgia is January 2 through March 31.

To make it simple for those filing for the first time, here are the Tax Commissioners Offices for filing your claim:

CHEROKEE COUNTY – 678-493-6120

http://qpublic.net/ga/cherokee/exemptions.html

CLAYTON COUNTY – 770-477-3311

http://www.claytoncountyga.gov/departments/tax-commissioner/exemptions.aspx

COBB COUNTY – 770-528-8600

http://www.cobbtax.org/property/exemptioninformation

DEKALB COUNTY – 404-298-4000

http://taxcommissioner.dekalbcountyga.gov/TaxCommissioner/tc-home.html

DOUGLAS COUNTY – 770-920-7272

http://www.douglastaxcommissioner.net/Exemptions_31XR.html

FAYETTE COUNTY – 770-461-3652

https://www.fayettecountytaxcomm.com/subpages/Homestead.asp

FORSYTH COUNTY – 770-781-2106

https://www.forsythco.com/DeptPage.asp?DeptID=175&PageID=1681

FULTON COUNTY – 404-612-6440

http://www.qpublic.net/ga/fulton/homestead_inst.html

GWINNETT COUNTY – 770-822-8800

http://gwinnetttaxcommissioner.manatron.com/Tabs/Property/HomesteadExemption.aspx

HENRY COUNTY – 770-288-8180

http://www.co.henry.ga.us/taxcommissioner/propertytaxexemptions.shtml

PAULDING COUNTY – 770-443-7606

http://www.paulding.gov/index.aspx?NID=210

For more information, please contact the Loan Star Team of Gary and Jeff at gary@loanstarteam.com or jeff@loanstarteam.com. Stay connected and follow us on LinkedIn!

Thursday, January 22, 2015

Tax Benefits to Owning a Home

There’s certainly no better place than home and even more so when it comes to tax time each year. Below are 8 financial advantages to owning a home.

1. You build equity in your home each month.

Equity in a home is the amount of money you can sell your home minus what you still owe on your mortgage. Every time you make a mortgage payment, a portion of that goes toward paying down your principal. The way mortgages work is that the principal portion of your payment increases slightly every month year after year. It’s lowest on your first payment and highest on your last payment. The reduction in your mortgage each month, increases the equity in your home!

3. Tax deduction benefits.

There are a few tax deductions that can help alleviate some of the tax burdens which may be associated with owning a home. Below are just a few deductions you should be taking.

Mortgage deduction:Homeowners can deduct the interest they pay, since often times interest is the largest component in their payment.

Property tax:Real estate property taxes paid on your primary residence and a vacation home are fully deductible for income tax purposes.

Closing costs (when applicable):Homebuyers may pay origination fees that are charged by the lender when you apply for your home loan. The first year you purchase your home, you may deduct these fees, regardless if the origination fee was paid by you or the lender. The savings can be high since origination fees may be 1%, or higher!

To find out what your tax savings are after you purchase your home, use this handy mortgage calculator to find out your deductions and your savings!

4. Home Equity Lines are deductible.

In addition to your mortgage interest, you may also deduct your equity lines of credit. This allows you to shift your credit card debts to your home equity loan, pay a lower interest rate than the credit card interest rates, and get a deduction on the interest as well.

5. Buying is cheaper than renting.

Although the cost of renting may be cheaper the first year you own your home, over time, the interest you pay will eventually decrease and be lower than the rent you would have been paying. More importantly, you are actually building equity in a home you own and not spending all of your hard earned money on rent. So, instead of paying off your landlord’s home or building, you can pay off your own!

6. Receive a capital gains exclusion.

If you buy a home to live in as your primary residence for more than two years then you will qualify. When you sell, you can keep profits up to $250,000 if you are single, or $500,000 if you are married, and not owe any capital gains taxes. If you purchased your home anytime prior to 2003, chances are it has appreciated in value and this tax benefit will come in very handy.

7. A mortgage is similar to a savings account.

By making monthly payments on your mortgage, you are paying the principal balance down and building more and more equity in your home. In a sense, you are forced to save this money in a separate account, and when it’s time to sell your home, this equity becomes yours.

8. Unforseen circumstances.

A partial exclusion can be claimed if the sale was prompted by residential damage from a natural or man-made disaster or the property was "involuntarily converted," for example, taken by a local government under eminent domain law. This may include:

Buying a home in order to build equity is one of the main financial reasons buyers jump into the market. As we have seen above, there are quite a few advantages to owning a home. That is why many homeowners who have taken out a mortgage in order to buy do so in anticipation of the tax breaks that come with homeownership. Depending on your tax bracket, a first-time purchaser's 1040 tax deductions can heavily subsidize many of the expenses you have poured into your new home.

While a home is a good investment, it’s best to weigh the pros and cons of both buying and renting, and how cost effective these will be. Along with the joy of painting, plumbing and yard work, you now have some new tax considerations when purchasing a home.

If you are thinking about purchasing a new home, resale, or investment property, it’s important that you get pre-qualified before you start the home buying search.

To learn more or to get pre-qualified, contact the Loan Star Team of Gary or Jeff at gary@loanstarteam.com or jeff@loanstarteam.com.

Equity in a home is the amount of money you can sell your home minus what you still owe on your mortgage. Every time you make a mortgage payment, a portion of that goes toward paying down your principal. The way mortgages work is that the principal portion of your payment increases slightly every month year after year. It’s lowest on your first payment and highest on your last payment. The reduction in your mortgage each month, increases the equity in your home!

2. Homeownership can increase your wealth.

Buying a home can be a very savvy move and great financial investment, only when you purchase a home you can afford. In 2015, the idea of sticking to a home you can afford to gradually build wealth is a “rule” that just happens to be new and old at the same time.

Buying a home can be a very savvy move and great financial investment, only when you purchase a home you can afford. In 2015, the idea of sticking to a home you can afford to gradually build wealth is a “rule” that just happens to be new and old at the same time.

- Death

- Divorce or separation

- Job loss that qualifies for unemployment

- Employment changes that makes it difficult to make monthly payments and basic living expenses

- Multiple births from same pregnancy

Buying a home in order to build equity is one of the main financial reasons buyers jump into the market. As we have seen above, there are quite a few advantages to owning a home. That is why many homeowners who have taken out a mortgage in order to buy do so in anticipation of the tax breaks that come with homeownership. Depending on your tax bracket, a first-time purchaser's 1040 tax deductions can heavily subsidize many of the expenses you have poured into your new home.

While a home is a good investment, it’s best to weigh the pros and cons of both buying and renting, and how cost effective these will be. Along with the joy of painting, plumbing and yard work, you now have some new tax considerations when purchasing a home.

If you are thinking about purchasing a new home, resale, or investment property, it’s important that you get pre-qualified before you start the home buying search.

To learn more or to get pre-qualified, contact the Loan Star Team of Gary or Jeff at gary@loanstarteam.com or jeff@loanstarteam.com.

Wednesday, December 24, 2014

Home Trends and Predictions in 2015

The new year brings resolutions and predictions. Check out The Home Buying Institute’s Five Real Estate Predictions to Watch in 2015. Get an insider’s look at the prediction and how it relates to real estate housing, mortgage lending, and home buyers buying. Are you betting with or against these predictions?

Prediction 1: Home values will continue rising, but more slowly than 2014.There is no such thing as a “the” housing market when it comes to pricing trends. It is a local thing. We understand that to be true as we view housing markets throughout the country. In states or cities where population is increasing and job opportunities are plentiful, housing would be more active than parts of our country that are depressed or deficient in employment openings.

CoreLogic, a financial data firm, published its annual HPI Forecast that predicts monthly home price gains and annual pricing trends stated it is expected that home prices will rise from July 2014 to July 2015 by 5.7%. July is the time for families with school age children who make enrollment a priority when relocating. Following winter break is another time that home demands may be on the rise and may precipitate price gains.

Generally speaking the consensus is that residential property values will continue rising in 2015 but at a slower pace than what has been seen in the previous 12 months.

Prediction 2: Double-digit gains will be limited to California and the Southwest.According to a real estate information company, Zillow, it believes that the rapid pricing gain will be in California and the Southwest. Their data is stating that double digit increases will most likely be in only a select few cities in California and the Southwest.

A map featured in this article indicates cities that may see a double-digit price gain include ten cities in California, Reno and Las Vegas, Nevada. Zillow uses their predictions based on their own pricing models, housing trends, sales prices, and other data.

Prediction 3: Mortgage Rates should remain low through first half of 2015.

In the latest comments from the Federal Reserve earlier this month, the Fed indicated they plan on keeping rates relatively low for the first part of 2015. Rates today resemble the historic rates of Dec of 2007 for the 30 year conventional fixed rate. Unlike 2007 though, the Jumbo rates are much lower today than seven years ago. Additionally government rates are as low as I have seen them in my 23 year mortgage career. Do not rule out some rate volatility as both the stock market and bond market move now on predictions, speculation, and emotion as opposed to logic and data. But overall rates will assist in making home buying affordable in all price points. This is a nice Christmas present from the Fed as we begin 2015.

Prediction 4: Foreclosures will continue to decline, as a percentage of total inventory.

When the housing market crashed, activity of home foreclosures was on the rise and continued to remain so over the last few years. Soon foreclosures declined which brought back confidence to the real estate market, both to buyers and sellers. With competitive, low mortgage rates, buyers anticipated the joys of home ownership. Distressed properties were fewer and values of homes were appraised closer to their true value. This confidence was uplifting to the real estate market and mortgage lenders.

The foreclosure market has not completely disappeared, and according to Realty Trac, a company that monitors foreclosure activity, states that we will not “cross the finish line until early 2015”. Many analysts are in agreement with this prediction. A decline in foreclosure activity will help solidify home prices, normalize inventory, and allow more move up buyers to help boost the housing market, as well as the overall economy.

Prediction 5: Mortgages Will Be Easier to Obtain.

In July, the Federal Reserve released a report that stated mortgage lenders are “relaxing their standards” mostly in debt ratios and credit scores. Lenders are allowing for credit scores to be lower and debt ratios to be higher for borrowers. The reason for this “relaxation” is due to the reduction in loan applications. Lenders needed to increase the volume of borrowers, and found the best solution was to loosen their lending standards.

In Vegas, the house always wins eventually. In 2015, the Loan StarTeam sees homebuyers winning. There is a perfect formula in play here: reasonable and rational appreciation of homes, affordability with low rates merged with a renewed sense of consumer confidence, and lower unemployment numbers. 2015 could be the best time for buying and selling real estate in the last seven years. Here is to 2015, a year we all win in the housing market.

CoreLogic, a financial data firm, published its annual HPI Forecast that predicts monthly home price gains and annual pricing trends stated it is expected that home prices will rise from July 2014 to July 2015 by 5.7%. July is the time for families with school age children who make enrollment a priority when relocating. Following winter break is another time that home demands may be on the rise and may precipitate price gains.

Generally speaking the consensus is that residential property values will continue rising in 2015 but at a slower pace than what has been seen in the previous 12 months.

A map featured in this article indicates cities that may see a double-digit price gain include ten cities in California, Reno and Las Vegas, Nevada. Zillow uses their predictions based on their own pricing models, housing trends, sales prices, and other data.

Prediction 3: Mortgage Rates should remain low through first half of 2015.

In the latest comments from the Federal Reserve earlier this month, the Fed indicated they plan on keeping rates relatively low for the first part of 2015. Rates today resemble the historic rates of Dec of 2007 for the 30 year conventional fixed rate. Unlike 2007 though, the Jumbo rates are much lower today than seven years ago. Additionally government rates are as low as I have seen them in my 23 year mortgage career. Do not rule out some rate volatility as both the stock market and bond market move now on predictions, speculation, and emotion as opposed to logic and data. But overall rates will assist in making home buying affordable in all price points. This is a nice Christmas present from the Fed as we begin 2015.

When the housing market crashed, activity of home foreclosures was on the rise and continued to remain so over the last few years. Soon foreclosures declined which brought back confidence to the real estate market, both to buyers and sellers. With competitive, low mortgage rates, buyers anticipated the joys of home ownership. Distressed properties were fewer and values of homes were appraised closer to their true value. This confidence was uplifting to the real estate market and mortgage lenders.

Prediction 5: Mortgages Will Be Easier to Obtain.

In July, the Federal Reserve released a report that stated mortgage lenders are “relaxing their standards” mostly in debt ratios and credit scores. Lenders are allowing for credit scores to be lower and debt ratios to be higher for borrowers. The reason for this “relaxation” is due to the reduction in loan applications. Lenders needed to increase the volume of borrowers, and found the best solution was to loosen their lending standards.

In Vegas, the house always wins eventually. In 2015, the Loan StarTeam sees homebuyers winning. There is a perfect formula in play here: reasonable and rational appreciation of homes, affordability with low rates merged with a renewed sense of consumer confidence, and lower unemployment numbers. 2015 could be the best time for buying and selling real estate in the last seven years. Here is to 2015, a year we all win in the housing market.

Thursday, October 16, 2014

5 Secrets that Keep Closings on Track and Money in Your Pocket

Secret #1 - Keep Your Deal from Drowning

One or two times a year, the flood gates

open…..figuratively, and an independent flood certification notifies me that

one of the properties I am financing is in a flood zone. Informing all parties the subject property is

in a flood zone is no fun. To the naked eye, the subject property does not look

like it is in flood zone. Many times the

seller did not have to buy flood insurance when he purchased the home. Telling all parties involved that the

topography has changed since the property was last purchased is like Noah

trying to convince his neighbors that live on the hill that they too should

build an ark.

Fortunately, I have a good solution for you and your clients

when you run into this scenario. Do not linger in disbelief of the

determination. Realize the first step is

to work with your lender to appeal

the determination by the flood certification company. Avoid the natural temptation to talk the

lender into believing you. Instead find

out what your lender requires to solve the problem….to prove the subject

property is not in the flood zone, flood insurance is not required, and the

closing can take place…and ultimately the home can be sold.

The solution is to contact a land survey company, have an

elevation survey shot, and then work through the process of having the flood

certification company amend their certification. Now the price and time it takes to do this

will vary. Time is critical to keeping

the closing on track. The sooner you

have the elevation survey shot and work to correct/amend the flood

certification, the more likely you are to avoid a the black cloud of

uncertainty that blows a termination and release to the property from the

south.

The last flood certification issue I had was this past

July. The listing agent, Tracy Haskins,

found the perfectly qualified man for the job!

His name is James Carter with Carter Land Surveying. Simply put, he knows the drill. James knows exactly what to provide AND the fastest way to resolve the issue with

the flood certification companies.

His knowledge is invaluable and his fee is fair. Save this information:

James Carter

404-213-5706

If you have ever run into this issue, you know how important

a James Carter is. If you have not…hope

you do not, but anticipate that you might, and keep this number for future reference. My goal is to share resources and expertise that

may keep your sale on track and not be washed away.

Stay tuned for Secret #2.

Wednesday, July 30, 2014

Avoid “The Big Gotcha” When Closing on Your Home Loan

My

iPhone rang and on the other end of the phone was one of my clients,

distraught, rushing to explain how the buyer (and the buyer’s lender) of her

house did not have their cash to close verified yet. Closing would be

delayed, her interest rate would need to be extended, and her blood pressure

rocketed while realizing moving plans had to be reconstructed. Some form

of this scenario happens ALL TOO OFTEN in today’s mortgage

industry.

Two reasons why the Big Gotcha happens...

1) Borrowers are not properly educated as to the importance of verifying cash to close and establishing a reasonable timeline.

2) Today, more than ever, mortgage lenders create a thorough paper trail and document every dollar used in buying and closing on a new home.

The best way to avoid THE BIG GOTCHA is to make a game plan with your lender. From the beginning, understand the amount of money you need to have verified in your bank account, when the money must be verified, and what documentation is needed for all non-payroll related deposits.

A checklist to help you avoid delays and surprises…

Two reasons why the Big Gotcha happens...

1) Borrowers are not properly educated as to the importance of verifying cash to close and establishing a reasonable timeline.

2) Today, more than ever, mortgage lenders create a thorough paper trail and document every dollar used in buying and closing on a new home.

The best way to avoid THE BIG GOTCHA is to make a game plan with your lender. From the beginning, understand the amount of money you need to have verified in your bank account, when the money must be verified, and what documentation is needed for all non-payroll related deposits.

A checklist to help you avoid delays and surprises…

1) Email your lender specifically where your money is coming from for the closing. Use specific dollar amounts if coming from multiple sources.

2) Establish a timeline with your lender on when those funds will be in the main bank account.

3) Request in writing from your lender what documentation will be needed to verify funds.

4) Contact your lender (as many times as necessary) before you move money from one account to another, get a gift for closing funds, sell an asset to another individual for funds to close or liquidate or borrow against a retirement account….yes, PLEASE over communicate!

5) Funds for closing must be wired to the closing agent’s account. Contact the closing agent for wiring instructions and a time frame for when the wire should be sent. Typically wiring funds 24 hours in advance is recommended.

Cash to close on the purchase of a new home can come in a variety of ways, including tapping into a 401k, receiving a gift from a family member, a settlement, selling a car, or selling jewelry... just to name a few. I have even had buyers sell a race horse for funds for closing.

Examples of standard documentation required by a lender…

1) If using equity from sale of current home, please provide copy of closing statement on sale of home.

2) If selling an asset, please take picture of asset then provide documentation to establish a fair market value (e.g., blue book value if selling a car),. Also provide bill of sale, copy of check, and copy of deposit slip showing funds going into your bank account.

3) If tapping into a retirement account, please get a copy of the monthly statement, a copy of the check or proof of wire, and a copy of the deposit slip.

4) Getting a gift from a family member is great! Simply get gift letter from your lender, get the letter signed by all parties, and get a copy of the check and deposit slip showing funds going into your bank account.

At this point you may be able to relate to the catch phrase, “moving paper through a paperless society" from Dunder Mifflin; the fictional paper company in Steve Carell’s sit- com, The Office. Simply put, it is “documentation overkill." Accept it as fact and then move forward with supplying the documentation.

The

main thing you can do to avoid THE BIG GOTCHA is to work with your lender to

create a game plan on what needs to be documented and when the money AND

documentation will be ready.

Two big “NO NO’s"...

1) Please do not sell an asset for cash or get a gift funds in cash. Cash is near impossible to document. You can see a common theme in this process: connecting the dots from where the money came from into the bank account that is being used for cash to close on your new home.

2) Do not wait till the last minute. Stay out in front of this potential pitfall by communicating with your mortgage banker. If you are going to be out of town during any part of the loan process alert your lender and processor. Going on a cruise for 10 days during the loan process without the right preparation and planning is likely to create a BIG GOTCHA. Yes, it happens.

My goal is to provide you some checkpoints to avoid last minute chaos and disappointment. Cash to close is a very big deal! Typically there is a fair amount of documentation needed for cash to close. In an age where technology is so advanced and the speed of communication is instantaneous, it is surprising how common this issue can potentially be. Uneducated, unguided buyers are left with a frustrated (sometimes furious) look on their face as they scramble, jump, and crawl through last minute hoops to satisfy the lending requirements for cash to close.

Buyers that plan and prepare in advance will continue to their closing without interruption. Please use this checklist so that you can be that buyer! It will ensure a more pleasant home buying experience, which is my goal as well as your Realtor’s goal.

Two big “NO NO’s"...

1) Please do not sell an asset for cash or get a gift funds in cash. Cash is near impossible to document. You can see a common theme in this process: connecting the dots from where the money came from into the bank account that is being used for cash to close on your new home.

2) Do not wait till the last minute. Stay out in front of this potential pitfall by communicating with your mortgage banker. If you are going to be out of town during any part of the loan process alert your lender and processor. Going on a cruise for 10 days during the loan process without the right preparation and planning is likely to create a BIG GOTCHA. Yes, it happens.

My goal is to provide you some checkpoints to avoid last minute chaos and disappointment. Cash to close is a very big deal! Typically there is a fair amount of documentation needed for cash to close. In an age where technology is so advanced and the speed of communication is instantaneous, it is surprising how common this issue can potentially be. Uneducated, unguided buyers are left with a frustrated (sometimes furious) look on their face as they scramble, jump, and crawl through last minute hoops to satisfy the lending requirements for cash to close.

Buyers that plan and prepare in advance will continue to their closing without interruption. Please use this checklist so that you can be that buyer! It will ensure a more pleasant home buying experience, which is my goal as well as your Realtor’s goal.

Sunday, June 29, 2014

The only thing we have to fear, is fear itself……inflationary fear

Two

observations I have seen since I became a mortgage banker on October 1st

1991: 1) the most commonly asked

question in the mortgage business is, “What is your interest rate?” and 2) the

biggest change I have seen in the last twenty three years in the mortgage

business is rates move on emotion and speculation, before economic data is released and studied. How are these two observations linked

together?

Interest

rates have major impact on monthly payment.

Homeowners want to know what price range they should be shopping in and

what mortgage payment they can afford.

Rates dictate affordability in the buyer’s mind. Rates are constantly advertised and used as a

primary decision maker for purchasing or refinancing. Mortgage companies go to great lengths to

advertise interest rates. Governments

attempt to stimulate or slow the economy thru regulating rates. In short, the perception is interest rates

rule the psyche of the consumer.

So it is no

surprise that mortgage bankers are asked to predict the future of rates every

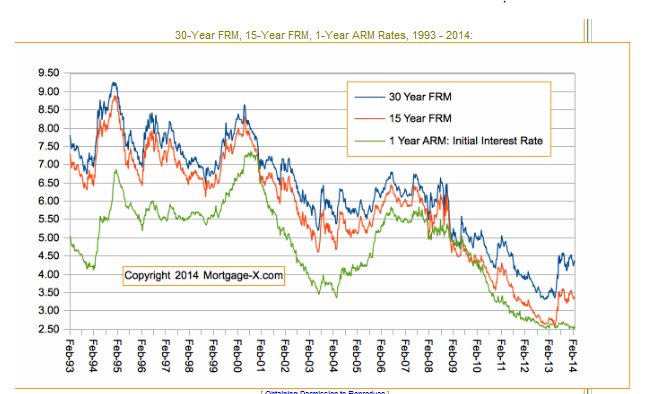

time we answer the phone. Based on this historical chart it is easy to

predict rates will go up. The only

question is “when?” The answer is

simple. Rates will go up when

speculation and emotion drive them up.

When I entered the mortgage business economic data would come out first,

suggesting how strong the economy was (or was not) and rates would move

accordingly, providing a true reflection of the state of our economy. Today, perhaps much like the stock market, the

market prices interest rates in anticipation

of what economic data will be released and speculative

interpretation of how that signals the state of our economy.

A recent

move in interest rates serves as a great example of this observation. Fifty three weeks ago, interest rates for a

30 year fix were resting at close to a 42 year low. Then one Tuesday, the Federal Reserve hinted

that the Federal Government would begin tapering off on their monthly purchase

of Mortgage Backed Securities (MBS). In

the span of 4 hours, rates rocketed to .75% in rate, rates moved from 3.5%

range to 4.25% range on a 30 year fixed.

“When is turns, it burns” and ouch…that day left a scorching burn! Keep in mind the cause of this rocket- like

rise was a hint……a hint the government was tapering.

|

| Reprodeced with the permission of Mortgage-X.com |

None of us

need to be a recognized, published economist to understand rates are low,

really low and affordability is up. Historical data suggest we are near the

basement of the interest rate cycle.

Rates will go up. The question is

when will rates go up? Many “experts” believe

rates will stay low for a while. The

government has a huge debt service. Low

interest rates are in the government’s best interest. The economy is getting stronger. Jobs are coming back from overseas to

America. Some prognosticators believe

the DOW is going to 18,000 +. Today,

one year later, many experts see tapering as a positive sign the economy can

stand without the aid of the government.

What a difference a year makes!

Consumer confidence is going up and unemployment is going down. We are in an election year (just ask Eric

Cantor). All these factors suggest rates

should stay steady for a while. But as

Lee Corso says every Saturday on ESPN in the fall, “Not so fast my

friend!” Nothing, and I mean nothing

makes rates race up like inflationary fears. Beware that the speculation of inflation is

growing like a tidal wave at sea. Be

alert and listen for the anticipation of inflation. The government keeps a watchful eye on

inflation. Short of a national tragedy,

nothing will make for a dramatic increase in rates go up in a recovering

economy like inflationary fears.

So do not

fear “inflationary fears”. Anticipate

it. Lock in on rates at your first

opportunity. Do not find yourself in the

same shocking position as those 53 weeks ago who returned from lunch to learn

rates had jumped from 3.5% range to 4.25% range one afternoon in the

summer. There is no warning of rates

going up when speculation and emotion gain momentum…..especially when it

relates to inflation. Remember gasoline

prices going from $1.50 to $3.00/ gallon overnight? Bingo!

Subscribe to:

Posts (Atom)